January 2025 – Financial Safety Nets: Exploring Available Sources of Emergency Funds

By Matthew Wisehaupt on January 17, 2025

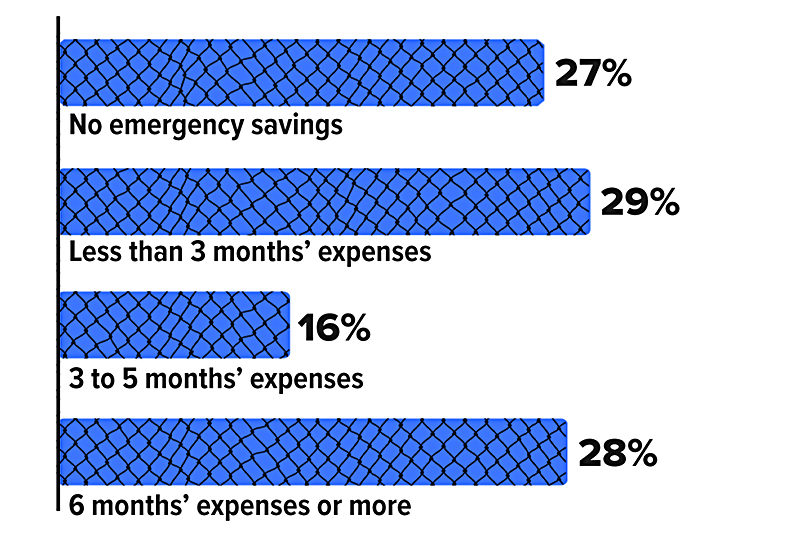

In moments of unexpected financial turmoil, having access to emergency funds can be the difference between a minor inconvenience and a major life disruption. Whether you have a sudden medical bill, car repair, or job loss, knowing where to turn for emergency financial support is crucial. However, not everyone has access to a financial safety net — nearly 60% of U.S. adults are uncomfortable with their level of emergency savings.1 Fortunately, there are options when it comes to exploring available sources of emergency funds.

Emergency savings account

A separate account dedicated solely to emergencies is the cornerstone of any financial plan and acts as the first line of defense in times of crisis. Generally, you’ll want to have at least three to six months’ worth of living expenses (e.g., mortgage, groceries, or car loan) in a readily accessible account. The actual amount, however, should be based on your particular circumstances, such as your job security, health, and income. In addition, review your emergency fund from time to time — either annually or when your personal or financial situation changes (e.g., a new baby or buying a home).

How Much Adults Have in Emergency Savings

Credit cards and personal loans

While not ideal, credit cards can provide immediate access to funds in an emergency. They are particularly useful for covering short-term expenses that can be paid off quickly in order to avoid paying high interest rates. Cards that offer balance transfers with low introductory rates can also be used, as long as you are disciplined with your repayments in order to avoid incurring additional debt. Personal loans from banks, credit unions, or online lenders can also be a viable option for covering emergency expenses. These loans often come with fixed interest rates and structured repayment plans. However, loan eligibility and interest rates will vary, depending on the lender and your personal financial situation. And of course it takes time to obtain a loan.

HELOCs

For homeowners, a home equity line of credit (HELOC) is a revolving line of credit secured by the equity you’ve built in your home. Unlike a home equity loan, which provides a lump sum, a HELOC functions more like a credit card. You can borrow up to a predetermined credit limit and repay over time, with the ability to borrow again as needed during the draw period. This option usually offers lower interest rates and more flexibility compared to credit cards or personal loans. However, there are some drawbacks to using a HELOC. Most HELOCs have variable interest rates, which means payments can increase if interest rates rise. In addition, since a HELOC is secured by your home, you could face foreclosure if you can’t repay it.

Retirement accounts

When faced with an unexpected expense, another possible source of emergency funds is a retirement account, such as a 401(k) or IRA. Although most withdrawals prior to age 59½ are subject to income tax and a 10% penalty tax, you may be able to take penalty-free early distributions for specific emergencies. These include disability, extraordinary unreimbursed medical expenses, disaster recovery, up to $1,000 per year for general emergencies, and other situations. Ordinary income taxes and certain restrictions apply.

In addition, many 401(k) plans allow participants to take out loans. Typically, you can borrow up to 50% of your account balance or $50,000, whichever is less. The loans generally must be repaid within five years unless used for a first-time home purchase. You may also be able to take a hardship withdrawal in certain circumstances. Hardship withdrawals may be subject to the 10% early withdrawal penalty, as well as ordinary income tax. Check with your plan or IRA administrator to see what options are available to you.

Finally, keep in mind that contributions to a Roth IRA can be withdrawn at any time without taxes or penalties, since they are made with after-tax dollars. Nonqualified withdrawals of earnings, on the other hand, are subject to ordinary income taxes and the 10% early withdrawal penalty. Qualified Roth IRA withdrawals are those made after five years and the account owner reaches age 59½, dies, or becomes disabled.

1) Bankrate’s 2024 Annual Emergency Savings Report