February 2024 – The Federal Reserve’s Key Meeting Dates in 2024

By Matthew Wisehaupt on February 1, 2024

The Federal Reserve’s rapid series of interest rate hikes throughout 2022 and 2023 — initiated in an effort to bring down red-hot inflation — rippled throughout financial markets and the broader economy.

People pay attention to the “Fed” to see where interest rates are headed, but also for its economic analysis and forecasting. Members of the Federal Reserve regularly conduct economic research, give speeches, and testify about inflation and unemployment, which can provide clues about where the economy is going. This information can be useful for consumers when making borrowing and investing decisions.

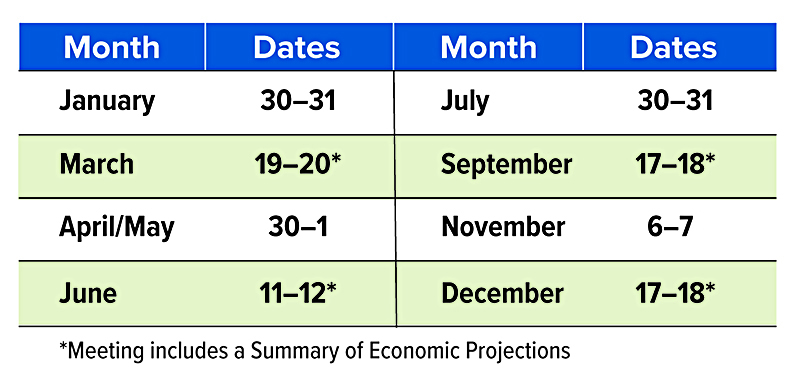

Eight meeting dates in 2024

The Federal Open Market Committee, or FOMC, is the arm of the Federal Reserve responsible for setting monetary policy. It typically meets eight times per year.

Because financial markets often react to FOMC meeting decisions, knowing the scheduled meeting dates ahead of time might be helpful when digesting economic news. The minutes of regularly scheduled FOMC meetings are released three weeks after the meeting date on federalreserve.gov.

The Fed’s key objectives

The Federal Reserve System was created by the Federal Reserve Act of 1913. The Fed is charged with three main objectives: maximum employment, stable prices, and moderate long-term interest rates. The first two objectives are often referred to as the Fed’s “dual mandate.” Over the years, the Federal Reserve’s duties have expanded and evolved to include maintaining stability of the entire U.S. financial system.

After its brisk series of rate increases in 2022 and 2023, the Fed has held the federal funds rate mostly steady. Going forward, it will continue to monitor economic data — including inflation, employment growth, bank sector stress, and credit conditions — as it determines future moves.

The federal funds rate is a benchmark rate that influences other interest rates throughout the economy, such as for mortgages, credit cards, and business loans. A higher federal funds rate typically drives up the cost of borrowing.

Source: Federal Reserve, 2023